Discretional Or System Based Trading?

What type of trader are you?

Before moving the big bucks in your account you should make a choice if you are a discretionary or system based trader.

Discretionary trading means that it is decision based: you decide if you want to hop onto new trades or not based on current market conditions. You choose yourself on how to execute and manage your trades.

System based trading means that you have a set of rules and enter into trades regardless of current conditions. You simply follow your rules and execute every single trade based on these rules.

Discretionary and system trading can be equally rewarding, it is just the question which one suits your personality better.

It took me a few years to find out which category fits my character better and after swapping back n forth i chose to trade purely discretionary to have more freedom.

Why?

A set of losers of course affect your trading and risk management and let me rather step back from the markets for a while. A few nice winners (happens more often luckily) gives me the freedom to skip a few trades and especially towards the end of a month makes me decreasing my position sizes substantially in order to end the month profitable.

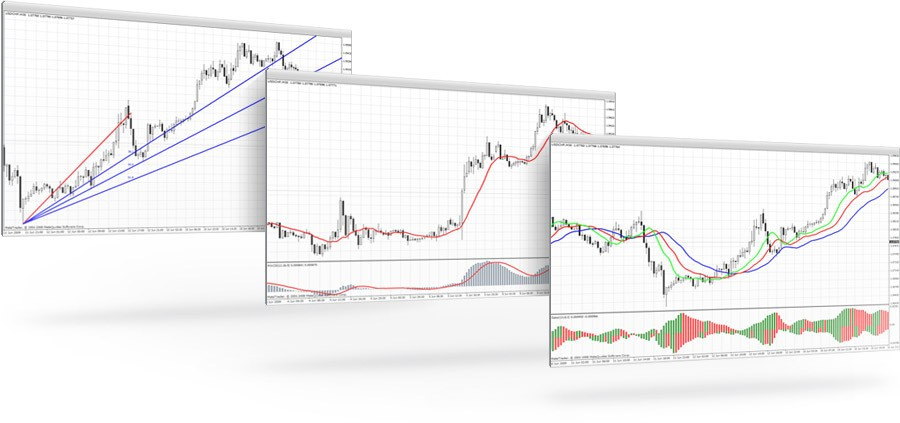

Discretionary trading is decision based trading, where i decide which trades i take, based on the current market situation. Are there some big news events coming up? Is an involved currency part of a region, which is currently unstable? Is there an increase of volatility coming up due to an election? As a discretionary trader you should still follow a strict trading plan with clearly defined trading rules but it is up to you on how to execute and manage your trade based on them.

Maybe you have a set of rules and before entering into a new position in the markets all rules are met but due to an upcoming news event in the near future you decide not to take the trade. The advantage of this behavior is that you are able to adjust your trading to the current market environment and can for example also adjust your position sizes accordingly.

The downside of discretionary trading however is, that maybe after a set of losing trades you are reluctant to take another position as your psychology kicks in.

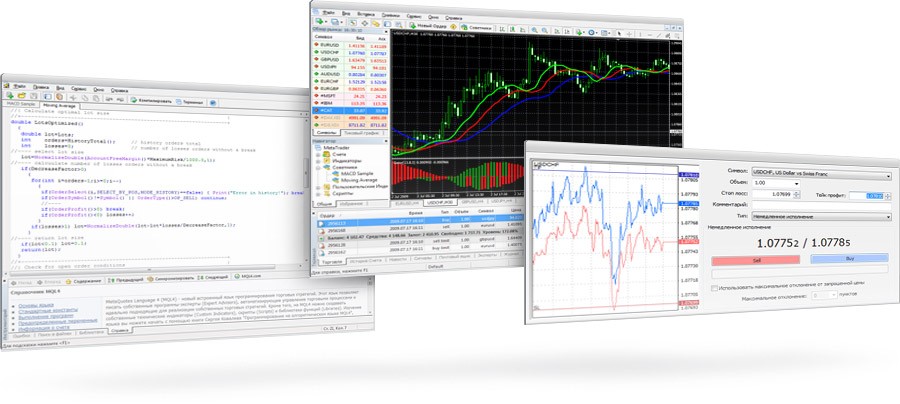

System trading is strictly rule based. You totally follow the rules in your trading system and execute them. This system is also the best to automate as regardless of the market environment you just need to manage your trades no matter what. Once a set of rules has been defined they could easily be implemented into a computer program and then being executed automatically. The psychology of the trader will then not have any effect on the trades itself.

The problem with this trading strategy is that it is not adaptive to changing market conditions. When the criteria of taking trades are met, trades will simply be executed. Of course there could be also various extra rules set to add up to special market conditions but these are also likely to affect the winning trades of the system.

Both approaches to trading have the same goal to make money. In the end both strategies might even produces similar trades but it really depends on your personality which strategy fits you the most.

Discretionary trading fits me the most as i like to be in control of my trading. I like to be able depending on the current market environment when to adjust stop losses or take profit parameters, depending on the actual situation.

System based trading might be more suitable for traders who like to back test strategies, come up with various sets of rules and simply execute trades without a second opinion or extra analysis. Mostly they have these strategies being executed by computer programs.

For you maybe also a mix of both is key (this is how i fine tuned my strategies in the end): being a discretionary trader using very defined system trading rules for entries and position sizes. Once my trade is executed i manage the stop loss and take profit parameters depending on the actual market movement. As a system trader you do not have this option as you have to stick to your rules, as they are defined.

I hope this gives you some food for thought, as both approaches have definitely very important facts that should match your mentality.

We should do a webinar about this topic soon as well, to talk about this in more detail.